1-HISTORY OF TRADE AND

COMMERCE IN INDIA

A. One Word or One Line Questions

Q. 1. How did

India establish trade relations with the rest of the world?

Ans.

India established trade relations with the rest of world through ‘Silk Route’.

Q. 2. According to archaeological evidence, which were

two main routes for trade from India?

Ans. Land route and sea

route.

Q. 3. Which system of exchange was prevalent in times

of ancient civilization?

Ans. Barter system of

exchange.

Q. 4. In which form of money came into existence with

the progress of civilization?

Ans.

With the progress of civilization, metallic money came to existence.

Q. 5. Name some

of the important economic activities of people in ancient India.

Ans.

Agriculture, domestication of animals, weaving cotton, dyeing fabrics,

handicrafts, sculpting, masonry etc.

Q. 6. Which were the intermediaries who played an

important role in the promotion of trade and commerce in ancient India?

Ans.

These intermediaries were: brokers, distributors, commission agents, Jaga

seths, bankers etc.

Q. 7. Name the

taxes imposed on trade and commerce in the ancient India.

Ans. Octroi duty, custom

duty, ferry tax, labour tax etc.

Q. 8. Name any

four major trade centres in ancient India.

Ans. Pataliputra,

Peshawar, Taxila, Mathura.

Q. 9. Write any

four major exports of India in ancient times.

Ans. Spices, indigo,

opium, copper etc.

Q. 10. List any four major import items of ancient

India.

Ans.

Gold, silver, lead, rubies etc.

B. Fill in Blanks

1. India’s

maritime trade with the rest of the world was done through____route.

2. The local bankers in ancient India were known as

_____

3. ____and____ were two financial instruments

which were used to carry-out transactions in ancient India.

4. A hundi which is payable at sight is _____ hundi.

5. _____hundi

is that hundi which is payable after a specific period of time.

6. ______ Hundi is drawn to cover the risk

involved in the process of transit of goods.

Ans.

1. silk, 2. jagat seths, 3. Hundi and chitti, 4. darshani, 5. Muddati, 6. Jokhami

C. True/False

1. ‘Silk route’ was a maritime route for trade.

2. India’s civilisational centres like Harappa and

Mohenjodaro had no trade and commerce relations with other contemporary

civilisations.

3. The development of a traditional system of weights

and measures also made a significant contribution in the promotion of trade and

commerce in ancient times.

4. A hundi is

not capable of change through transfer.

5. Firman-jog

hundi is payable on the order of the payee.

Ans. 1. False, 2.

False, 3. True, 4. False, 5. True, 6. True, 7. True, 8. True

D.

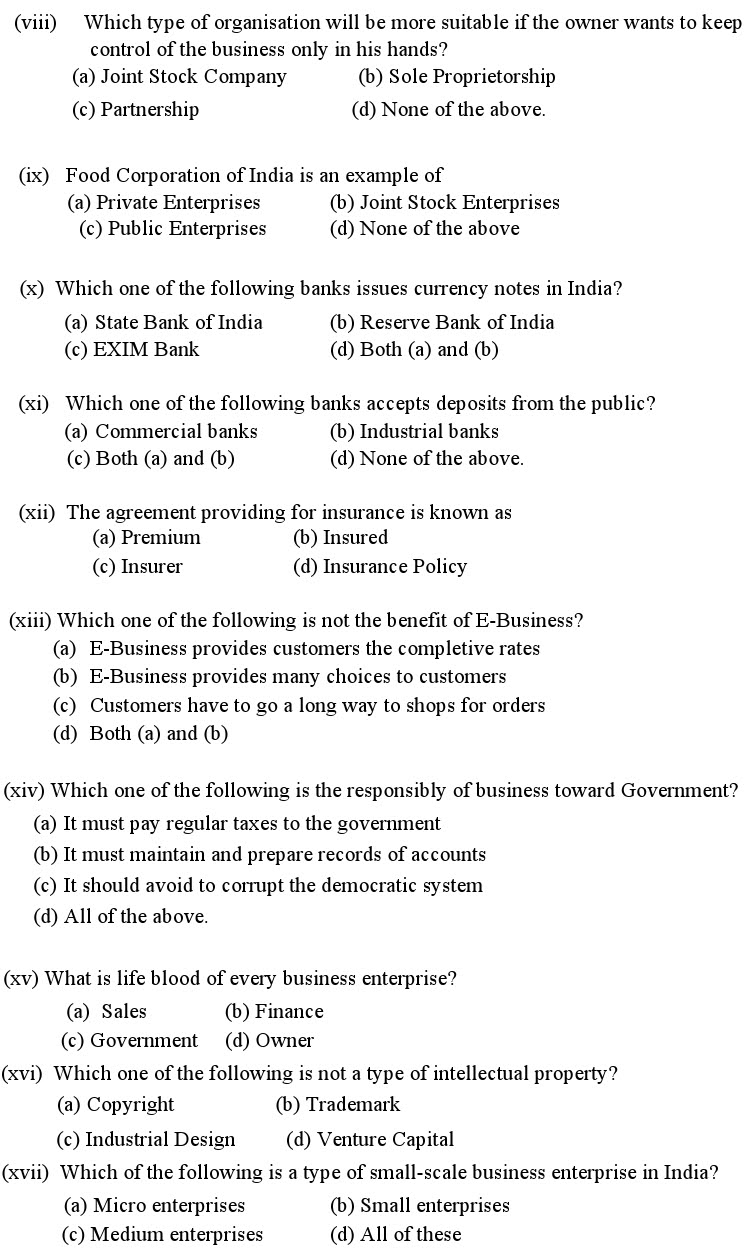

MCQ

1. Which of the following contributed in the

development of trade and commerce in ancient India?

(a) Evolution of money

(b) Development of a traditional system of weights and

measures

(c) Development of indigenous banking system

(d) All of these.

2. Which of the following is not a feature of Hundi?

(a) It warrants the payment of money

(b) It is not capable of change through transfer

(c) It is not capable of change through transfer by

valid negotiation

3. The development of indigenous banking system

promoted which of the following activities in the ancient India?

(a) Agriculture

(b) Domestication of animals

(c) Small factories in the form of karkhanas

(d) All of these.

4. Who provided loans for foreign trade in ancient

India?

(a) Intermediaries (b) Government

(c) Both (a) and (b) (d) None of these

5. At which of the following trading centres of

ancient India, did Chinese ships used to visit for trade?

(a) Pulicat (b) Calicut

(c) Both (a) and (b) (d) None of these.

6. By whom, were guilds organised in ancient India?

(a) Local bankers

(b) Intermediaries

(c) Trading communities

(d) All of these.

7. Which of the following taxes, was not imposed on

trade and commerce in ancient India?

(a) Sales tax

(b) Octroi tax

(c) Ferry tax

(d) Custom

duty.

Ans. 1. (d), 2. (b),

3. (d), 4. (a), 5. (b), 6. (c), 7. (a),

2-NATURE AND PURPOSE OF

BUSINESS

One Word or One Line Questions:-

Q. 1. Name the types of activities.

Ans. (i) Economic

Activities. (ii) Non-Economic Activities.

Q. 2. What is

the main aim of economic activities?

Ans. The main aim of

economic activities is to satisfy human desires and wants.

Q. 3. In which

activities profit element is present?

Ans. Economic Activities.

Q. 4. Give two examples of Economic Activities.

Ans. (i) Teacher

teaching in a school. (ii) Worker working in a factory.

Q. 5. Give two examples of Non-Economic Activities.

Ans. (i) Mother

cooking food for her baby. (ii) Doctor giving free medicines to poor patients.

Q. 6. What are the categories of Economic Activities?

Ans. (i) Business (ii)

Profession (iii) Employment.

Q. 7. Name examples of Business Activities.

Ans. (i) Industrial activities (ii) Trade

activities (iii) Aids to trade.

Q. 8. Give any one example of industrial activity.

Ans. Purchase of raw

material and others necessary industrial inputs.

Q. 9. Give any one example of trade activities.

Ans. Producers

supplying goods to wholesalers.

Q. 10. Give one example of aid to trade.

Ans. Banks extending

all types of financial services to trade and industry.

Q. 11. Name any

one important professional body in India.

Ans. The Institute of

Chartered Accountants of India.

Q. 12. What is must for profession?

Ans. Specialised

knowledge, training and qualification is must for a profession.

Q. 13. Who is employer?

Ans. The person who hires employees is called employer.

Q. 14. Who are employees?

Ans. The persons who

work under the contract of employment are called employees.

Q. 15. Give one

feature of employment.

Ans. The employees get

salaries or wages of the services rendered to the organisation.

B. Fill in the blanks

1. Human beings are having _________ wants.

2. The main objective of every business is to

___________

3. The persons who work under the contract of

employment are called ………..

4. The employees get …….. for the services rendered to

the organization.

5. Marketing

consists of efforts for the sale or exchange of ……….

6. ______ are

required for the survival of the business.

Ans. 1. False,

2. True, 3. False, 4. False, 5. True, 6. False

D.

MCQ

1. Human activities are classified into

................... categories:

(a) 3 (b) 5

(c) 1 (d)

2

2. The primary aim of every business activity is to:

(a) Help Society

(b) Earn Profits

(c) Help its Suppliers (d) Help its Competitors

3. Which one of the following is not the feature of

business?

(a) Creation of utilities (b) Regular dealings

(c) Profit motive (d)

Non-economic activities

4. Professionals charge...........for rendering

services.

(a) Rent (b)

Profit

(c) Fee (d)

Interest

5. Which one of the following is the feature of

profession?

(a) Specialised knowledge (b) Professional fee

(c) Specific code of conduct (d) All of these

6. Which one of the following is not the feature of

Profession?

(a) Specialised knowledge (b) Professional fee

(c) Profession association (d) Open entry

Ans. 1. (d), 2. (b),

3. (d), 4. (c), 5. (d). 6. (d)

3-Classification of

Business Activities

A. One

Word to One Sentence Questions

Q. 1. Name some

Industrial Goods.

Ans. Machinery, Equipments, Tools, Plants etc.

Q. 2. Name some Intermediate Goods.

Ans. Rubber, Plastics, Aluminium.

Q. 3. What are the categories of Industries?

Ans. Primary,

Secondary, Tertiary.

Q. 4. Which type of industries are included in

the Primary Industry?

Ans. Genetic Industries, Extractive Industries.

Q. 5. Name two types of secondary industries.

Ans. (i) Construction

Industry

(ii) Manufacturing Industry.

Q. 6. Name the types

of manufacturing industries.

Ans. (i) Analytical Industry (ii)

Synthetic Industry (iiii) Processing

Industry.

Q. 7. Name the

categories of service industry.

Ans. (i) Transport (ii)

Insurance (iii)

Warehousing

(iv) Banking

(v) Advertising.

Q. 8. What is insurance?

Ans. It provides coverage for all types of risks

related to business.

Q. 9. Name the

components of commerce.

Ans. Trade and Aids to Trade.

Q. 10. Name the types of trades.

Ans. Internal Trade, External Trade, Wholesale

Trade, Retail Trade.

Q. 11. What is retail trade?

Ans. Retail trade involves buying of goods from

the manufacturers and selling them in small quantatities.

Q. 12. What do you mean by Aids to Trade?

Ans. The agencies which facilitate trade are

known as aids to trade.

Q. 13. Define business

risks.

Ans. According to Wheeler, “Risk is the chance of

loss. It is the possibility of some unfavourable occurrence.”

Q. 14. Name the causes of business risks.

Ans. (i) Physical Causes (ii) Natural Causes (iii) Human Causes (iv) Economic Causes.

Q. 15. Write down two

physical causes of business risk.

Ans. (i) Wear and Tear of machinery (ii) Mechanical defects in

machines.

Q. 16. Write down two economic causes of

business risk.

Ans. (i) Fluctuations in Demand (ii) Increase in

Competition.

B.

Fill in the blanks

1. ……………fills the gate between producer of

goods and service and their consumers.

2. Construction

Industry is an example of ………….

3. ......... provides

coverage for all types of risks related to business.

4. ......... is used

for storing of raw materials and finished goods.

5. ......... removes

the hindrance of finance.

6. Commerce is

basically concerned with the transfer of................ .

7. When the goods are

produced according to local demands it is called............. .

Ans. 1. Service

industries 2.

Secondary industries,

3. Insurance, 4.

Warehousing,

5. Banking, 6.

goods

7 local trade.

C.

True or False

1. Commerce is

concerned with exchange of goods and services for profit.

2. Banks make the

consumer aware about the availability of goods in the market.

3. Trade refers to

purchase and sale of goods and services.

4. When the trader of

one country purchases goods from seller of the foreign countries, it is known as

export trade.

5. Banks provide

short term and long term funds to the business enterprises.

Ans. 1. True, 2. False, 3. True, 4. False 5.

True

D.

MCQ

1. The units which

are engaged in manufacturing of products are collectively known as:

(a) Firms (b)

Commerce

(c) Industry

(d) Trade

2. Import and Export

Trade is an example of:

(a) Internal Trade (b)

Foreign Trade

(c) External Trade (d)

Both b and c

3. ......... deals

only with buying and selling of goods.

(a) Trade (b) Industry

(c) Commerce

(d) All of the above

4. The trade is

confined to the boundaries of the state is known:

(a) Provincial Trade

(b) Local Trade

(c) External Trade

(d) None of the above

5. Which one of the

following is not the type of foreign trade?

(a) Import Trade (b)

Export trade

(c) Provincial Trade (d)

Entrepot trade

6. Which of the

following services come under aids to trade?

(a) Banking and

Insurance

(b) Transportation and Communication

(c) Both (a) and (b)

(d) None of the above.

Ans. 1. (c), 2. (d),

3. (a), 4. (a), 5. (c), 6. (c)

4-SOLE-PROPRIETORSHIP

A. One Word or one Line Questions

Q. 1. Define Sole-Trader.

Ans. According to

James Stephenson, “A Sole-trader is a person who carries on business

exclusively by and for himself.”

Q. 2. What is

the extent of liability of a sole proprietor?

Ans. Unlimited liability.

Q. 3. What is the reward for starting sole-proprietorship?

Ans. All profits of

the business belong to sole proprietor.

Q. 4. What is

the limitation for not expanding sole proprietary business?

Ans. The financial

resources are limited and managerial talent is also limited.

Q. 5. Can a sole proprietor add a partner in the

business?

Ans. No, the entry of

a partner will make it a partnership concern.

Q. 6. What is

the advantage of admitting a partner?

Ans. The new partner

brings with him some additional capital and experience which will help in the expansion

of business.

Q. 7. Can a

sole proprietor employ a servant for help?

Ans. Yes, a sole

proprietor can employ a servant for help.

B. Fill in the blanks

1. A sole-trade business is owned by……..

2. Sole-trader is the………judge of his business.

3. The liability of a sole-trader is…….

4. Sole-proprietorship is a………form of organisation.

5. The area of

operation of sole-trade is………

6. Sole-proprietorship is subject to minimum

government….…….

Ans. 1. one man, 2.

Supreme, 3. Unlimited,

4. stable,

5.

limited, 6. regulations

C. True or False

1. Sole-trader is the ‘supreme judge’ of his business.

2.

Sole-proprietorship is subject to strict government regulations.

3. A sole-trader and his business are not different

entities.

4. A sole-trader is not in a position to enjoy the

benefits of hereditary goodwill.

5. The managerial ability of sole-trader is limited.

6. One man

business is generally run on large scale basis.

Ans. 1. True, 2.

False, 3. True, 4. False, 5. True, 6. False.

D.

MCQ

1. Sole-trade

organisations are also called as:

(a) Individual Proprietorship

(b) Single

Entrepreneurship

(c)

Sole-Proprietorship

(d) All of the

above

2. Sole-Proprietorship is best suitable when risk

involved is:

(a) Minimum

(b) High

(c) Both (a) and (b)

(d) None of the above

3. Which one of the following is not the feature of

Sole-Proprietorship?

(a) Individual ownership

(b) Limited Liability

(c) Limited scope of operation

(d) One man

management

4. Which one of the following is the advantage of

sole-proprietorship?

(a) Easy to Form

(b) Self-employment

(c) Socially desirable

(d) All of

these.

Ans. 1. (d), 2. (a),

3. (b), 4. (d).

-5- PARTNERSHIP

A. One Word or One Line Questions

Q. 1. Which act

governors partnership firm?

Ans. Partnership Act,

1932.

Q. 2. What is

the position of liability in partnership?

Ans. The liability of

partners is unlimited.

Q. 3. What does unlimited liability mean in

partnership?

Ans. Unlimited

liability states that personal assets of the partners can also be used to pay

business liabilities.

Q. 4. How does partnership overcome the limitations of

sole-proprietorship?

Ans. By pooling

financial and managerial resources and sharing business risks.

Q. 5. Name the

business organisation which can be formed by oral agreement among members?

Ans. Partnership.

Q. 6. Name the enterprise which is owned by minimum

two persons.

Ans. Partnership.

Q. 7. Define

Co-ownership?

Ans. When a property

is owned by more than one person, then it is called co-ownership.

Q. 8. Which type of partnership firm is formed for a

specific purpose?

Ans. Particular

Partnership.

Q. 9. Name the type of partnership which is started to

carry out a particular task. Ans. Particular

partnership.

Q. 10. Name the type of partnership in which liability

of members is unlimited and all of them can take part in management.

Ans. General

partnership.

Q. 11. Give two merits of partnership organisation.

Ans. (i) Easy

formation (ii) Greater managerial ability.

Q. 12. Name two

limitations of partnership organisation.

Ans. (i) Unlimited

liability. (ii) Limited resources.

Q. 13. Name the

document prepared in partnership.

Ans. Partnership deed.

Q. 14. What do

you mean by Partnership deed or agreement?

Ans. When all partners

sign as a written agreement, then it is called partnership deed or as articles

of partnership.

Q. 15. Is it

essential to prepare partnership deed in writing?

Ans. No.

B. Fill in the blanks

1. Partnership is an association of………..

2. In partnership, all partners have a right to

participate in the……..of business.

3. In General Partnership, the liability of members

is………

4. Partnership form of organisation is suitable for

......... size of business.

5. No partner can ......... or ......... his share to

other without the ......... of all the partners.

Ans. 1. Two or more

persons, 2. Working,

3. Unlimited, 4. Medium,

5. Sell, transfer.

C. True or False

1. In India, partnership is governed by Indian

Partnership Act, 1932.

2. Profit is not the main objective of a partnership

business.

3. In the absence of any agreement, every partner has

equal share in the profits.

4. Partnership deed is must for the existence of

partnership.

5. The liability of partners is limited.

6. Partners can sell or transfer his share to other

without the consent of all other partners.

Ans. 1. True, 2.

False, 3. True, 4. True, 5. False, 6. False.

D.

MCQ

1. Which one of the following is not a feature of

partnership?

(a) Agreement between partners (b) Sharing of profit

(c) Limited liability (d)

Utmost good faith.

2. Which type of partnership firm is formed for a

specific purpose?

(a) Limited Partnership (b) Particular Partnership

(c) Partnership at Will (d) General Partnership

3. A minor is a person who has not yet attained the

age of

(a) Nineteen Years (b)

Eighteen Years

(c) Twenty one Years

(d) Twenty Years

4. The other name of sleeping partner is

(a) Secret Partner (b)

Dormant Partner

(c) Sub Partner (d)

Nominal Partner

Ans. 1. (c), 2. (b), 3. (b), 4. (b)

-6- HINDU UNDIVIDED FAMILY BUSINESS

A. One

Word or One Line Questions

Q. 1. What is meant by Hindu Undivided Family

Business?

Ans. It refers to a form of organisation wherein

the business is managed and controlled by the eldest male member of the family

know as ‘Karta’ of the family.

Q. 2. Which form of

organisation has membership by birth?

Ans. Hindu Undivided

Family Business.

Q. 3. Name the two

schools of thought which govern membership of Hindu Undivided Family Business.

Ans. (i) Mitakshara (ii) Dayabhaga.

Q. 4. How many

members are required to establish a Hindu Undivided Family Business?

Ans. At least two members.

Q. 5. What is the main source of capital in

Hindu Undivided Family Business? Ans. Ancestral

property.

Q. 6. Does the death

of karta dissolves the family firm?

Ans. No, the firm continues.

Q. 7. Who manages and controls the affairs of

Hindu Undivided Family Business? Ans. Eldest male

member of the family.

Q. 8. Name the head

of Hindu Undivided Family Business.

Ans. Karta.

B.

Fill in the blanks.

1. The Full form of

JHF is

2. The liabilities of Karta are

3. The continuity of Joint Hindu Family

is

4.

keeps all business secrets to himself.

5. There must be minimum members to form a

Hindu Undivided Family.

Ans. 1. Joint Hindu Family, 2. Unlimited,

3. Permanent, 4. Karta,

5.

two

C.

True or False.

1. Karta enjoys

complete freedom in the choice of business.

2. Registration is

compulsory for Hindu Undivided Family Business.

3. 'Karta' keeps all

business secrets to himself.

4. A minor can become

a partner in the partnership firm.

5. There must be

minmum ten members to form a Hindu Undivided Family.

Ans. 1. True, 2.

False, 3. True, 4. False, 5. False

D.

MCQ

1. On the basis of

schools of Hindu Law, Joint Hindu Family can be divided into following

categories.

(a) Mitakshara

(b) Dayabhaga

2. Minimum number of

members to form a Joint Hindu Family:

(a) Three

(b) Four

(c) Five (d) Two

3. Which one of the

following is the merit of Hindu Undivided Family Business?

(a) Freedom in choice

of business (b) No

legal formalities

(c) Continuity (d)

All of the above.

4. Which one of the

following is not the merit of Hindu Undivided Family Business?

(a) No legal

formalities

(b) Unlimited liability

(c) Limited

managerial skill (d) Continuity.

Ans. 1. (a), 2. (d),

3. (d), 4. (c)

-7- CO-OPERATIVE SOCIETIES

A. One Word or One Line Questions.

Q. 1. What do

you mean by co-operative society?

Ans. A form of organisation, where in persons

voluntarily associate together as human being on the basis of equality for the

promotion of economic interests of themselves.

Q. 2. Under

which act co-operative societies is registered?

Ans. A co-operative

society is registered under Indian Co-operative Societies Act, 1912.

Q. 3. How many members can start a co-operative

society?

Ans. 10 adult members.

Q. 4. How is capital raised by co-operative society?

Ans. Capital is raised by issuing shares to the members.

Q. 5. What is the status of liability of members of

the co-operative society?

Ans. The liability of members is limited.

Q. 6. Name office bearers of co-operative society.

Ans. President,

Vice-president, Secretary, Treasurer.

Q. 7. Give any two principles of Co-operative

Societies.

Ans. (1) Voluntary

Membership (2) Democratic Management

Q. 8. Is registration of the co-operative society is

compulsory?

Ans. No, it is

optional.

Q. 9. State two

merits of a co-operative society.

Ans. (i) Open

membership (ii) Democratic management.

Q. 10. Which co-operative society is started to

protect the interests of weaker sections?

Ans. Consumer

co-operative society.

Q. 11. Which co-operative societies helps its members

to do farming on scientific basis?

Ans. Co-operative farming society.

Q. 12. Which-co-operative society extend credit

facilities to members?

Ans. Credit

co-operatives.

Q. 13. Name a

co-operative society providing help their members to construct their own house.

Ans. Housing

Co-operatives.

Q. 14. Which societies help small producers in selling

their products at good price? Ans. Marketing

co-operative societies.

Q. 15. What is

the voting pattern for members of a co-operative society?

Ans. ‘One person, one

vote’.

B. Fill in the blanks Fill in the blanks

1. The co-operative society is registered

under......... .

2. Membership of co-operative societies

is................ .

3. The management of a co-operative society is always

elected in.......... way.

4. In co-operative society, the voting rights are

based on the principle......... .

5. The primary objective of the society is......... .

6. Trading in co-operative societies is done

one............ basis.

Ans. 1. Indian

Co-operative Societies Act, 1912,

2. Voluntary, 3.

Democratic,

4. one person, one vote, 5.

Service First, Profit Second,

6. Cash.

C. True or False

1. The main aim of co-operative societies is to

protect the interest of the society.

2. High rate of interest is paid to members in reward

for their contribution to the capital of society.

3. The Primary objective of the society is ‘Profit

first, Service second’.

4. In a co-operative society, the voting rights are

based on ‘One Person, One Vote’.

5. In co-operative societies, trading is done on

‘credit basis’.

Ans. 1. True, 2.

False, 3. False, 4. True, 5. False.

D.

MCQ

1. The consumer co-operatives are established for the

benefit of

(a) Upper class people

(b) Lower and Middle Class People

(c) Both (a) and (b) (d)

None of the above

2. The main aim of co-operative society is to

(a) Earn Profits (b)

Serve the Society

(c) Both a and b (d)

None of the above

3. Co-operative societies generally transact business

on:

(a) Cash Basis (b)

Credit Basis

(c) Both Cash and Credit Basis (d) None of the above

4. Which one of the following is the feature of

co-operative societies?

(a) Voluntary membership (b) Democratic management

(c) Limited liability

(d) All of these.

5. Which one of the following is not the merit of

co-operative society?

(a) Open and voluntary membership (b) Democratic

management

(c) Surplus of Goods at higher rate (d) Low management cost.

6. Which one of the following is not the limitation of

co-operative societies?

(a) Lack of Secrecy (b)

Inefficiency of management

(c) surplus shared by members (d) Government interference.

Ans. 1. (b), 2. (b),

3. (a), 4. (d), 5. (c), 6. (c)

-8- JOINT STOCK COMPANY

A. One Word or One Line

Questions

Q. 1. Under which

act companies are governed?

Ans. Companies Act,

2013.

Q. 2. Which

form of organisation is called an artificial person created by lawy? Ans. Joint Stock Company.

Q. 3. How is a company an artificial person?

Ans. A company is

created by law and has separate legal entity.

Q. 4. Is it compulsory for a company to get registered?

Ans. Yes.

Q. 5. Name a

form of organisation where members can transfer their shares without consent

from anyone.

Ans. Joint Stock Company.

Q. 6. Give the

names of Indian Statutory Companies.

Ans. Reserve Bank of

India, Life Insurance Corporation of India, Unit Trust of India, Indian Airline

etc.

Q. 7. Indian Oil Corporation is an example of which

type of company?

Ans. Government Company.

Q. 8. Who

contributes capital in joint stock company?

Ans. Shareholders.

Q. 9. What can be the maximum number of members in a

public company?

Ans. No limit.

Q. 10. How many minimum members can form of a public company?

Ans. Seven Members.

Q. 11. How much minimum paid capital is required for a

public company?

Ans. Rs.5 lakhs.

Q. 12. Who manages the Joint Stock Company?

Ans. Board of

Directors.

Q. 13. What is the minimum and maximum number of

members of a private company?

Ans. A minimum of two

members are required and the maximum number is 200.

Q. 14. Name the type of company where members are

restricted to transfer their shares.

Ans. Private Company.

Q. 15. How much minimum paid up capital is required

for a private company?

Ans. Minimum of Rs. 1

lakh paid up capital.

Q. 16. What is the minimum number of directors of a

private and public company?

Ans. Private Company: 2

Public

company: 3

Q. 17. What is minimum quorum of members at tending

meeting of a private and a public company?

Ans. Private company:

2 members; Public company: 5 member s

Q. 18. De fine One Person Company.

Ans. One person

company is a company which has only one personas member.

Q. 19. How much maximum paid up share capital of one person

company.

Ans. Not more than Rs. 50 Lakhs.

Q. 20. What is the limit of annual turnover of one person

company?

Ans. Annual turnover

should not exceed Rs. 2 crore.

B. Fill in the blanks:

1. A company is an ......... per son created by........

.

2. In India, Joint Stock Companies are governed by........

.

3. A Joint Stock Company works on ......... basis.

4. ......... company have no need to issue a

prospectus or to file a statement in lieu of prospectus with the registrar.

5. Shareholder s of company is free to dispose of

their ................ .

6. Maximum number of member s of a private company is

................ .

Ans. 1. Artificial, law, 2. Companies Act, 2013,

3. Democratic, 4.

Private,

5. shares, 6. 200.

C. True or False

1. A company enjoys a separate legal entity from its

members.

2. Shareholder s of a public company is free to

dispose of their shares.

3. A Joint Stock companies works on democratic basis.

4. In India, Joint Stock Companies are governed by

Companies act, 2008.

5. Minimum number of member s of private company is

ten.

6. The name of the Private company end with the words.

‘Public Limited’.

7. Joint Stock Company is managed and controlled by

Board of Director s .

Ans. 1. True,

2. True, 3.

True, 4. False,

5. False,

6. False, 7. True

D. MCQ

1. A public company must have at least following

number of member s.

(a) Six

(b) Two

(c) Seven (d) Nine

2. The maximum number of member s in case of private

company.

(a) Fifty one (b)

Fifty two

(c) Fifty five (d)

None of the above

3. The number of member s require to complete a quorum

of a private company.

(a) Three (b)

Four

(c) Two (d)

Five

4. Which one of the following company can issue share

warrants?

(a) Public Company

(b) Private Company

(c) Both (a) and (b)

(d) None of the above

5. Which one of the following is not a limit at ion of

Joint Stock Company?

(a) Difficulty informat ion (b) Lack of quick decisions

(c) Democratic set up

(d) Excessivestate regulations

Ans .1. (c), 2. (d), 3. (c), 4. (a), 5.

(c)

-9- FORMATION OF A COMPANY AND CHOICE OF FORMS OF BUSINESS

A. One Word or One Line

Questions

Q. 1. Define promotion?

Ans. According to Hoagland, “Promotion is a

process of creating an enterprise.”

Q. 2. When does

company come into existence?

Ans. A company comes into existence when a number

of persons join hands together to achieve some common object.

Q. 3. Name various

stage in the formation of a company.

Ans. (i) Promotion

(ii) Incorporation (iii) Raising of Capital (iv) Commencement of Business.

Q. 4. What is the

effect of ‘Certificate of incorporation’?

Ans. After incorporation, the company becomes a

separate legal entity and comes into existence from the date of incorporation.

Q. 5. Is certificate

of commencement necessary for all companies?

Ans. All companies whether public or private,

having share capital require certificate of commencement of business.

Q. 6. What is the

full form of MOA and AOA?

Ans. Memorandum of Association and Articles of

Association.

Q. 7. Who is called Promoter?

Ans. A promoter is one who undertakes necessary

steps to form a company.

Q. 8. What is

Memorandum of Association?

Ans. It is a document

which sets out the constitution of the company.

Q. 9. What is

Articles of Association?

Ans. It is a document which sets out the

regulations for the internal management of the company.

Q. 10. What do you

mean by Prospectus?

Ans. It is a document which is issued by a

company to invite the public to deposit money in the form of shares or

debentures.

Q. 11. Name the steps

involved for formation of a company.

Ans. Promotion, incorporation, raising of capital

and commencement of business.

Q. 12. Name two

factors influencing choice of form of business organisation.

Ans. (i) Capital

requirements (ii) Scale and scope of operations.

B. Fill in the blanks

1. The main purpose

of ......... is to set out the objectives of the company.

2. .............sets

out rules and regulations for the internal management.

3. A

..............provides the information to the general public regarding the

purpose for which the capital is required by the company.

4. ......... depend

upon the size of business to be started.

5. If the degree of

risk involved is ......... then sole-proprietorship form of organisation will

be suitable.

6. In case of large

scale business, the financial requirements are.........

Ans. 1. Memorandum of

Association, 2. Articles

of Association

3. prospectors 4. Capital Requirements,

5. low, 6.

more.

C. True or False

1. The name of the

company must be identical with the name of the company already registered.

2. The main purpose

of Memorandum of Association is to define the scope of activities of the

company.

3. A promoter

conceives an idea of starting a new business enterprises.

4. Promotional

aspects of the company are divided into three categories.

5. The capital clause

must state the authorised or nominal share capital of company.

Ans. 1. False,

2. True, 3.

True, 4.

False, 5.

True.

D. MCQ

1. A company is

incorporated under

(a) Companies Act,

1957 (b)

Companies Act, 2013

(c) Companies Act,

1958

(d) Companies Act, 1959

2. Memorandum of

Association defines

(a) Rights and

Objectives of the company (b)

Rights of the members

(c) Both (b) and (c) (d)

None of the above

3. The promoters who

are not in promotion work on regular basis are known as

(a) Professional

Promoters (b)

Financial Promoters

(c) Occasional

Promoters (d)

Both (b) and (c)

4. A public company

must use the word at the end of its name.

(a) Private Limited (b)

Limited

(c) Pb Limited (d)

All of the above

5. A form of business

organisation which is easy to form is called:

(a) Suitable

(b) Ideal

(c) Company

(d) Firm

6. Which factors are

to be considered for setting up a new business?

(a) Government Policy

(b)

Business Location

(c) Financial Analysis

(d)

All of the above

Ans. 1. (b), 2. (a), 3. (c), 4. (b) 5. (b), 6. (d)

10-PRIVATE SECTOR AND PUBLIC SECTOR ENTERPRISES

A. One Word or One Line

Questions

Q. 1. Name any

two Private Enterprises.

Ans. (i) Reliance

Industries Ltd., (ii) Bombay Dyeing.

Q. 2. Define

Public Sector Enterprises.

Ans. Public Sector

Enterprises are those which are owned, managed and controlled by government.

Q. 3. Give two examples of departmental undertaking.

Ans. (i) Railways.

(ii) Postal Department.

Q. 4. State one merit of departmental undertaking.

Ans. Public

accountability.

Q. 5. Name two

statutory corporation.

Ans. (i) Life

Insurance Corporation of India. (ii) Reserve Bank of India.

Q. 6. State two

features of statutory corporation.

Ans. (i) Incorporated

by special act of legislation. (ii) Public Accountability.

Q. 7. State two limitations of statutory corporation.

Ans. (i) Limited

Autonomy. (ii) Inflexibility.

Q. 8. Name the

company in which 51% shares are held by government.

Ans. Government

company.

Q. 9. Name any two government companies.

Ans. (i) Hindustan

Machine Tools. (ii) Indian Oil Corporation.

Q. 10. State any two merits of Government Company.

Ans. (i) Run on commercial

lines. (ii) Financial autonomy.

Q. 11. State two limitations of a government company.

Ans. (i) Red Tapism.

(ii) Official Domination.

Q. 12. State two economic objective of public

enterprises.

Ans. (i) Balanced

economic growth. (ii) Production of essential goods.

Q. 13. Which type of companies give due importance to

Social Objectives?

Ans. Public Sector Enterprises.

Q. 14. Which economic reform changed the role of

public sector?

Ans. Industrial

Policy, 1991.

B. Fill in the blanks

1. In Private

Sector Enterprises, the financial management is done by the........... .

2. Public enterprises are managed and controlled

by.........

3. Food Corporation is an example of...............

4. Departmental organisations work as a part of .........

and managed by.........

5. Statutory Companies are incorporated by.........

6. Railway is an example of..............

Ans. 1. Owners, 2. Government, 3. Public

enterprises,

4. Government, civil servants,

5. Special Act of

Parliament 6.

Departmental organization.

C. True or False

1. The main objective of private enterprises is to

earn profits.

2. Private sector enterprises are more efficient due

to quick decision making.

3. Indian Oil Corporation is an example of private

enterprises.

4. Departmental undertakings suffer from the evil of

Red Tapism.

5. Public enterprises are established to check

monopolies.

Ans. 1. True, 2. True,

3. False, 4. True, 5. True.

D. Multiple Choice Questions

1. Which one of the following is not a public sector

enterprise?

(a) Departmental Organisations

(b) Joint Hindu Family Business

(c) Public Corporation

(d) Government Companies

2. In case of government companies, the contribution

of govt. is atleast.

(a) 50% (b)

49%

(c) 51%

(d) 59%

3. Which one of the following is the feature of

Statuary Corporation?

(a) Statuary Corporations are incorporated by a

special Act of Parliament or of a State Legislature

(b) The Government invest entire share capital in the

corporation

(c) Both (a) and (b)

(d) None of the above.

4. Which one of the following is the feature of

Government Companies?

(a) Government Companies are register under the

Companies Act 2013

(b) Atleast 51% of paid up capital is contributed by

government

(c) Government company is managed by Board of Director

(d) All of the above.

5. Which one of the following is not the disadvantage

of Government Companies?

(a) Political Interference (b) Red Tapism

(c) Help in balance growth (d) Limited autonomy.

Ans. 1. (b), 2.

(c), 3 (c), 4 (d), 5 (c)

-11- MULTINATIONAL COMPANIES

A. One Word or One Line Questions

Q. 1. What is the full form of MNC?

Ans. Multinational Companies.

Q. 2. Name some

American MNCs.

Ans. Coca Cola, Pepsi,

Ponds, General Motors, IBM.

Q. 3. Name some British MNCs.

Ans. Lipton, Brook

Bond, Hindustan Liver etc.

Q. 4. State two

features of multinational companies.

Ans. (i) Operation in

number of countries. (ii)

Centralised management.

Q. 5. State two methods of operation of Multinational

companies.

Ans. (i) Opening of

Branches. (ii) Giving Franchise.

Q. 6. Give any two disadvantages of MNCs to Host

Countries?

Ans. Disregard for

National Priorities, Creation of monopolies.

Q. 7. State two features of Joint Venture.

Ans. (i) Joint

ownership and Management. (ii) Specified objectives.

Q. 8. State two types of Joint Ventures.

Ans. (i) Contractual

Joint Venture (CJV). (ii) Equity Based Joint Venture (EJV).

Q. 9. State two benifits of Joint Venture.

Ans. (i) Availability

of more resources. (ii) Reduction of competition.

Q. 10. State two drawbacks of Joint Venture.

Ans. (i) Conflicts

among partners. (ii) Problems concerning control and management.

Q. 11. State two benifits of Public Private

Partnership.

Ans. (i) Improvement

in efficiency. (ii) Rapid development of infrastructure.

Q. 12. Describe one disadvantage of Public Private

Partnership.

Ans. Project costs or

the cost of the services delivered under PPP model is high.

B. Fill in the blanks

1. MNC's have their headquarters in......... while

carry out business in.........

2. MNC's try to create......... by eliminating local

competition in the market.

3. Multinational companies carry on their operation in

number of..........

4. There is ............... in MNCs.

5. There is ............ in MNCs.

6. ......... is the best example of Joint Venture

Company.

Ans. 1. Home country, host countries, 2. Monopolies,

3. Countries, 4.

Centralized

5. Management, 6. Maruti

Udyog.

C. True or False

1. Adverse balance of trade is the major problem in

developing countries.

2. There is no need for franchise holder to follow all

the provisions mentioned in

franchise agreement.

3. Multinational Corporations are also called as

multinational companies.

4. MNCs try to dominate the markets of host countries.

Ans. 1. True, 2. False, 3. True, 4. True.

D. MCQ

1. Which type of corporation operates beyond the

boundaries of its home country?

(a) Multinational Corporation (b) Transnational Corporation

(c) International Corporation (d) Global Corporation

2. The main objective of multinational companies is to

make use of

(a) Raw materials (b)

Capital

(c) Labour or market of foreign countries (d) All of the above

3. Home country is the country where MNC is

(a) Incorporated

(b) Selling Its Products

(c) Producing Goods (d) All of the above

4. The home country of 'Suzuki and Sony' is

(a) America (b)

Italy

(c) Japan (d)

France

Ans. 1. (b), 2. (d), 3. (a) 4. (c)

-12- BUSINESS SERVICES

A. One Word to One Sentence

Questions

Q. 1. What are

business services?

Ans. Business Services consist of all those

activities which are concerned with manufacturing and distribution of goods.

Q. 2. Which are two types of funds required by

a businessman?

Ans. Every businessman requires two types of

funds i.e. long term and short term.

Q. 3. Write any one

point of importance of business service.

Ans. Business services enable a businessman to

provide better services to the customers.

Q. 4. Name any four

business services.

Ans. 1. Banking 2. Transportation 3. Insurance 4.

Underwriting.

B. Fill in the blanks

1. Banking,

transportation, insurance etc. are ............ services.

2. The commercial

organisations which provide business services are collectively

called..............sector.

3. ................

funds are needed for the purchase of fixed assets.

4. Specialised

financial institutions which provide long term finance are called

...............banks.

5. Business risks are

covered with the help of................. .

Ans. 1. business 2.

service 3. Long

term 4. development 5.

Insurance

C. True or False

1. Short term funds

are needed to meet day to day expenses of business.

2. Storage and safety

of goods does not come under business services.

3. Business services

help in increasing the sales.

4. Business services

help in the removal of place hindrance through transportation of goods.

5. Discounting of bills of exchange is not a

business service.

Ans. 1. True 2. False 3. True 4.

True 5. False

D. MCQ

1. Which of the following facts highlights

need for business services?

(a) To fulfill

financial requirements (b) Storage and safety of goods (c) both (a) and (b) (d) None of

these.

2. Which institutions

provide long term finance to the businessmen?

(a) Development Banks (b) Business Banks

(c) Both (a) and (b) (d) None of

these.

3. Which of the

following is a business service?

(a) Warehousing (b)

Advertising

(c) Installment of Credit (d) All of

these.

4. Which of the following is a correct statement?

(a) Long term funds are needed for purchasing fixed

assets.

(b) Short term funds are needed for purchasing fixed

assets.

(c) Short term funds are needed for purchasing plant

and machinery.

(d) None of these.

Ans. 1. (c) 2. (a) 3. (d) 4. (a)

-13-BANKING

A. One Word or One Line

Questions

Q. 1. State

main functions of commercial banks.

Ans. The main

functions of commercial banks are accepting of deposits from the public and

providing the loans to trade and industry.

Q. 2. What is the main function of agricultural banks?

Ans. Agricultural Banks provide long term

loans to farmers for purchase of agricultural tools and equipments.

Q. 3. Which agricultural bank provide short term loan

to farmers?

Ans. Co-operative

Banks.

Q. 4. Name the agricultural bank providing long term

loan to farmers.

Ans. Land Mortgage

Bank.

Q. 5. Give one main functions of industrial bank.

Ans. Industrial Bank

provide long term loans to industries for expansion and modernisation.

Q. 6. Which banks deal with foreign exchange business?

Ans. Exchange Banks.

Q. 7. When was NABARD established?

Ans. July 12, 1989.

Q. 8. When was Export-Import (EXIM) Bank established?

Ans.

EXIM Bank was established on January 1, 1982.

Q. 9. State two primary functions of State Bank of

India.

Ans.

(i)

To grant the loans. (ii) To deal in hundies and bill of exchange.

Q. 10. When was

RBI established?

Ans. Reserve Bank of

India was established in 1935.

Q. 11. Which

bank issue currency notes in India?

Ans. Reserve Bank of

India.

Q. 12. State two primary functions of commercial

banks.

Ans. (i) Acceptance of

Deposits. (ii) Granting of loans and advances.

Q. 13. State two secondary functions of commercial

banks.

Ans. (i) Collection of

cheques, bills etc. (ii) Purchase and sale of securities.

Q. 14. State

two utility functions of commercial banks?

Ans. (i) Underwriting

of securities. (ii) Issuing of traveler's cheque and letter of credit.

Q. 15. Which bank account promote the habit of savings

among the low and middle class?

Ans. Saving Bank

Account.

Q. 16. Which bank account is generally opened by

businessmen?

Ans. Current Account.

Q. 17. What is

the utility of current account?

Ans. In this account,

a depositor can withdraw and deposit money at any time during the working hours

without giving any notice to the bank.

Q. 18. What is fixed deposit account?

Ans. Fixed deposit

account is that account wherein a definite amount of money is deposited for a

fixed period and cannot be withdrawn before the expiry of that period.

Q. 19. What is Reccuring Deposit?

Ans. It is an account

in which the depositor agrees to deposit a definite amount of money every month

for a specific period i.e. one year, two years, five years etc. Q.

20. What is Bank Draft?

Ans. Bank draft is a

banking instrument through which customers can transfer or send money from one

place to another.

Q. 21. What is Bank overdraft?

Ans. Bank over-draft is a facility given to

the customer by the bank to overdraw his current account upto a specified

amount.

Q. 22. What is cash credit?

Ans. Under cash

credit, the bank advances loan to the customer by hypothecating his current

assets or fixed assets in its favour.

Q. 23. What is full form of RTGS?

Ans. Real Time Gross

Settlement.

Q. 24. What is full form of NEFT?

Ans. National Electronic

Fund Transfer.

B. Fill in the blanks

1. ......... is called the backbone of modern

commerce.

2. Bank is a financial institution which deals in

money and.........

3. ............ banks accept deposit from public and

provide loans to trade and industry.

4. ........banks deal with foreign exchange business.

5. .........acts as Banker's Bank.

6. Current account is also called

as...........account.

Ans. 1. Banking, 2. Credit,

3. Commercial, 4. Exchange, 5. RBI, 6.open.

C. True or False

1. Indigenous

Bankers provide long term loan to industries for expansion and m odernisation.

2. Imperial bank of India was nationalised and renamed

as State Bank of India on July 1, 1955.

3. State Bank

of India issue currency notes.

4. Reserve Bank of India deals with financial

policies.

5. A lump sum amount of advance made by a bank against

security or otherwise is called loan.

Ans. 1. False, 2. True, 3. False,

4. False, 5.

True

D. MCQ

1. Which one of the following banks provide long term

loan to farmers?

(a) Co-operative Banks

(b) Long Mortgage Banks

(c) Exchange Banks (d)

Industrial Banks.

2. Which one of the following banks issues currency

notes in India?

(a) State Bank of India (b) Reserve Bank of India

(c) EXIM Bank (d)

Both (a) and (b)

3. Which one of the following is the primary functions

of commercial bank?

(a) Acceptance of Deposits (b) Granting of loans and advances (c) Both

(a) and (b) (d) None of the above.

4. The other

name of fixed deposit account is

(a) Saving Bank

Account

(b) Fixed Deposit Receipt

(c) Fixed

Deposit Accountholder

(d) Term Deposit Account

5. The Reserve

Bank of India was established in

(a) 1936 (b)

1934

(c) 1935 (d)

1932 6.

6. NABARD was established in

(a) 1989 (b)

1979

(c) 1987

(d) 1980

Ans. 1. (c), 2. (b), 3. (c), 4. (d),

5. (c), 6.

(a)

-14- INSURANCE AND POSTAL SERVICES

A. One Word or One Line Questions

Q. 1. Define

insurance.

Ans. Insurance is

defined as the equitable transfer of the risk of a loss, from one entity to

another, in exchange for a premium.

Q. 2. What is insurance

policy?

Ans. Insurance policy

is a formal document in written which contains all the terms and conditions of

the contract of insurance.

Q. 3. Who is an insurer?

Ans. It is the

insurance company which undertakes the risk.

Q. 4. Who is an insured?

Ans. A person who has taken up the insurance

policy is called insured.

Q. 5. What is cover note?

Ans. It is an interim

protection note. It is issued by the insurer to the insured.

Q. 6. On what technique, insurance is based?

Ans. Insurance is

based on an important technique known as Tooling System'.

Q. 7. What are the Principles of Insurance?

Ans. Insurable

interest, utmost good faith, indemnity, subrogation, contribution, causa

proxima etc.

Q. 8. What is meant by insurable interest?

Ans. By insurable

interest we mean that there should be some pecuniary interest in the

subject-matter of insurance contract.

Q. 9. What is

the main difference between Insurance and Assurance?

Ans. The word

Insurance is used for fire and marine whereas assurance word is used for life

assurance policies.

Q. 10. What is Re-insurance?

Ans. When an insurance

company insures its risk with other companies it is known as re-insurance.

Q. 11. What is Double Insurance?

Ans. It means taking

more than one policies for the same subject matter.

Q. 12. What is the utility of Life Insurance?

Ans. Protection for

Family, Investment Credit Facility, Encourage Saving etc.

Q. 13. Name some types of Health Insurance Policies.

Ans. Mediclaim

Insurance, Disability Insurance, Maternity Insurance, Dreadful Diseases

Insurance.

Q. 14. What is Mediclaim Insurance?

Ans. This type of

health insurance policy covers the reimbursement of the expenses made on the

treatment during illness

Q. 15. Name some types of Fire Insurance Policies.

Ans. Valued Policy,

Specific Policy, Average Policy, Floating Policy, Reinstatement Policy etc.

Q. 16. What is Marine Insurance?

Ans. Marine Insurance

contract is an arrangement by which the insurer undertakes to compensate the

owner of the ship or cargo for complete or partial loss at sea.

Q. 17. Name types of marine insurance.

Ans. (i) Hull

Insurance (ii) Cargo Insurance (iii) Fright Insurance.

Q. 18. What is Jettison Clause?

Ans. This clause covers the loss caused by throwing off

certain cargo in order to lighten the load on a ship in emergency situations.

Q. 19. Mention any two types of postal services

available in India.

Ans. (i) Registered post (ii) Parcel.

Q. 20. What is speed post?

Ans. Speed post, a

fastest mode of communication, is used for sending letters and parcels in a

short period

B. Fill in the blanks

1. ......... provides cover age for all types of risks

and uncertainties of life.

2. ......... is issued by insurer to insured.

3. Only in ......... a person can claim for all the

policies under double insurance. (Life Insurance, Marine Insurance)

4. .........insurance is r elated with ship, cargo

etc.

5. .........insurance cover the loss due to dishonest

employee misappropriat ion or

embazzlement.

Ans. 1. Insurance, 2. Cover Note,

3. life insurance, 4. Marinem,

5. Fidelity

C. True or False

I. Under

without profit policy, the insured does not get any share in profits of the

insurance company.

2. The insurance policy is always unstamped.

3. Insurance contracts are not enforceable by law.

4. The life insurance policy is generally for a longer

period i.e. 10, 15, 20 years.

Ans. 1 True, 2.

False, 3.

False,

4. True.

D. MCQ

I. The agreement providing for insurance is known as

(a) Premium (b)

Insured

(c) Insurer (d)

Insurance Policy

2. In Marine Insurance, premium is paid in

(a) Regular Installments (b) Lumpsum Amount

(c) Monthly Installments (d) None of the above

3. Which type

of policy remains in force throughout the life of the assured, till his death?

(a) Endowment Policy (b) Group Insurance Policy

(c) Whole Life Policy

(d) With Profit Policy

4. The amount or fee paid under insurance policy is

known as

(a) Bonus (c)

Premium

(b) Subscription Fee (d)

Interest

5. Which one of the following service is provided by

Department of Posts in India? (a) Parcels (b)

Registered Post

(c) Speed Post

(d) All of these.

Ans. 1. (d),

2. (b), 3. (c),

4. (c), 5.

(d)

-15- CONCEPT OF E-BUSINESS AND BUSINESS OUTSOURCING

A.

One Word or One Line

Questions

Q. 1. What is E-Business?

Ans. E-Business is the process of doing business

online, may that be good or service.

Q. 2. What is the full form of B2B?

Ans. Business to Business

Q. 3. What is the full form of B2C?

Ans. Business to Consumer

Q. 4. Name two

resources required for successful E-Business implementation? Ans. (i) Adequate Computer System. (ii) Internet Connection.

Q. 5. State any one feature of e-business.

Ans. It is 24 hours and 7 days service.

Q. 6. What is meant by B2B?

Ans. The transactions taking place between

businesses companies are referred to business to business or B2B transactions.

Q. 7. Name two two

items included in e-Business.

Ans. (i) B2B (H) B2C.

Q. 8. What is B2C?

Ans. The transactions taking place between

business and consumer are known as business to consumer or B2C.

Q. 9. What is C2C

Commerce?

Ans. The transactions

taking place electronically between two or more consumer.

Q. 10. Name two

benefits of e-business?

Ans. (i) E-Business provides customers the

competitive rate. (ii) Market place.

Q. 11. What is meant

by online transactions?

Ans. It refers to transactions taking place

between buyers and sellers through internet.

Q. 12. What is the

common mode of payment for online purchases?

Ans. Through Credit Card and Debit Card.

Q. 13. Name two transaction risks in

e-business.

Ans. (i) Default on order taking (ii) Default on

delivery.

Q. 14. What points

should be kept in mind to ensure security of E-Commerce? Ans.

Authentication, Confidentiality, Integrity, Non-Repudiation etc.

Q. 15. What are the tools available to protect

Information?

Ans. Encryption, Firewalls, Digital Signatures.

Q. 16. What do you

mean by Encryption?

Ans. It is the process of encoding the data so

that it cannot be read by any wrong person.

Q. 17. BPO stands

for?

Ans. Business Process

Outsourcing.

Q. 18. What do you

mean by outsourcing?

Ans. It means availing the services of some

outside agencies.

B.

Fill in the blanks

1. ............. is

required for successful implementation of e-commerce.

2. ...............

refers to all the transactions that take place among persons or department of some

firm.

3. Full form of ISP

is.........

4. ......... is a

program delivered along with e-mails to delete data, mail copies etc.

5. Majority of the

electronic frauds are made by............... .

Ans. 1. Internet

connection, 2.

Infra B-Commerce,

3. Internet Service

Provider, 4. Trojan

Horses,

5. hackers

C. True or False

1. E-business is about buying and selling

products and services on WWW.

2. ISP stands for Internet Subscriber

Provider.

3. An adequate

computer system is required for successfully implementing e-commerce.

4. In B2C Commerce,

companies are allowed to sell goods and services to each other.

5. Majority of

electronic frauds are made by crackers.

Ans. 1. True 2. False,

3. True, 4. False, 5. True

D. MCQ

1. Which one of the following resources are

required for successful e-business implementation 7

(a) Adequate Computer System (b) Internet

Connection

(c) Well designed

website (d)

All of the above.

2. B2B stands for:

(a) Business to

Businessmen (b)

Business to Business

(c) Company to

business (d)

All of the above

3. Which one of the

following is the limitation of E-Business?

(a) Failure to know customers (b) No

customer loyalty

(c) Both (a) and (b) (d) None of the above

4. Which one of the following is the security

issues in E-Business?

(a) Hacking

(c) Virus and Trojan Horses

(b) Brand Hijacking (d) All of

the above

5. Which one of the

following is not a tool to protect Information?

(a) Encryption

(c)n Firewalls

(b) Trojan Horses

(d) Digital Signature.

6. Which services are

efficient and faster as compared to postal services?

(a) Advertisement Services (b) Customer

Support Services (c) Courier Services (d)

Both (a) and (c)

7. Preparing project

reports are covered under the head of

(a) Customer Support Services (b)

Underwriting of Shares

(c) Project Reports (d)

Financial Services

Ans. 1.

(d), 2. (b), 3. (c),

4. (d), 5. (b), 6. (c),

7. (d)

-16- SOCIAL RESPONSIBILITY OF BUSINESS AND BUSINESS ETHICS

A. One Word or one Line

Questions

Q. 1. What do you mean by Social

Responsibility?

Ans. Social Responsibility may be taken to mean

intelligent and objective concern for the welfare of the society.

Q. 2. What is ethical

responsibility of business?

Ans. A business should not be involved in

exploiting customers and employees.

Q. 3. What is legal

responsibility of business?

Ans. Every business is expected to follow rules

and laws for their proper control.

Q. 4. To whom is

Business responsible?

Ans. Shareholders, Investors, Employees,

Community, Government, Competitors, Consumers, Suppliers etc.

Q. 5. Give some arguments to support the

social responsibility of business.

Ans. Long term interest of business, creation of

society, human resources, avoidance of social pressure etc.

Q. 6. State any one

argument against assuming social responsibility by business. Ans. The objective of profit maximisation may not be

achieved.

Q. 7. State two reasons for the need of human

Right.

Ans. (i) Protection against human injustice. (ii)

Check on unlimited powers of the state.

Q. 8. Supplying quality goods at reasonable

prices, towards which group the business is performing this responsibility?

Ans. Consumers.

Q. 9. Give an example of responsibility of

business towards government.

Ans. To pay regular taxes to the government.

Q. 10. Mention any one responsibility of

business towards investors.

Ans. To ensure a adequate rate of return on his

investment.

Q. 11. State one

responsibility of business towards society?

Ans. It must ensure the optimum use of limited

natural resources of the country.

Q. 12. Give one responsibility of business

towards suppliers.

Ans. It must make timely payments to suppliers.

Q. 13. What is meant

by Business Ethics?

Ans. Ethics refers to code of conduct for

business.

Q. 14. Name two

factors affecting Business Ethics.

Ans. (i) Personal values (ii) Social values.

B. Fill in the blanks

1. A businessman has

to obey various ................ enacted by the government.

2. To ensure the

safety of workers, the business should provide better ......... conditions.

3. ......... work for

protection of human rights.

4. Ethics refer to .........

for business.

Ans. 1. Legislations, 2.

Working, 3. NGO's,

4. Code of Conduct

C. True or False

1. Business has no responsibility towards

society.

2. Business houses

have no need to prepare proper records of accounts.

3. Government of

India has established National Human Right Commission at national level with

chapters at state level.

4. The main causes of air pollution are

radioactive gases, carbon monoxide gases etc.

5. A business can

help the society by selling goods and services at prices which consumers are

willing to pay.

Ans. 1. False,

2. False, 3. True,

4. True, 5. True

D. MCQ

1. Business have responsibility towards:

(a) Community

(b) Government

(c) Employees

(d) All of the above

2. Which one of the following is the

responsibility of business towards investors? (a) Business must ensure a

adequate rate of return on their investment.

(b) Business ensure a

reasonable appreciation in the capital of the investors

(c) Both (a) and (b)

(d) None of these

3. Which one of the

following is not the responsibility of business towards employees?

(a) It must pay fair

wages or salaries.

(b) To ensure the

safety of workers, it should provide better working conditions. (c) It must ensure

them security for their jobs.

(d) All of the above

4. Which one of the

following is the responsibly of business towards Government? (a) It must pay

regular taxes to the government

(b) It must maintain

and prepare records of accounts

(c) It should avoid to corrupt the democratic

system

(d) All of the above

5. Which one of the

following is the responsibility of business towards Society?

(a) It must provide employment opportunities

to the society at large.

(b) It must ensure

the optimum use of scarce natural resources of the country.

(c) Both (a) and (b)

(d) None of these

Ans. 1. (d), 2 (c),

3. (d), 4. (d), 5. (c)

-17- SOURCES OF BUSINESS FINANCE

A. One Word or One Line

Questions

Q. 1. What do you

mean by Business Finance?

Ans. Business finance is that business activity

which deals with acquisition, and use of funds in order to achieve the overall

objectives of the business.

Q. 2. Name different categories of finance.

Ans. (i) Public Finance, (ii) Private Finance.

Q. 3. Name types of

Business Finance.

Ans. Long Term Finance, Medium Term Finance,

Short Term Finance.

Q. 4. What are the

main sources of medium term finance?

Ans. Debentures, Banks, Public deposits etc.

Q. 5. What are the

sources of short term finance?

Ans. Commercial Banks, Customer Advances, Trade

Creditors etc.

Q. 6. Name types of shares.

Ans. Equity Shares, Preference Shares, Deferred

Shares.

Q. 7. Why is equity

share called a permanent source of funds?

Ans. Because equity share capital can be returned

only on the liquidation of the company.

Q. 8. Name types of preference shares.

Ans. Cumulative, non-cumulative, redeemable,

irredeemable, participating, non-participating, convertible and non-convertible

preference shares.

Q. 9. What are

Deferred Shares?

Ans. These are known as promoters or founders

shares because these are issued to promoters for their services rendered to the

company.

Q. 10. What is Retained Earnings?

Ans. It refers to that part of total profits which

are re-invested or re-employed into business.

Q. 11. Which category

of shareholders participate in the management of the company?

Ans. Equity shareholders.

Q. 12. Out of owners'

funds and borrowed funds, which one is a permanent source of finance?

Ans. Owner's funds.

Q. 13. What do you

mean by FDI?

Ans. Foreign Direct

Investment means direct investments in projects of domestic economy by a

foreign investors.

B. Fill in the blanks

1. Shor t finance is

generally r equired for a period of .........

2. Other name of

owner 's fund is .........

3. Convertible

preference shares can be converted into......... shares after a specified

period of term.

4. ......... is a

document of acknowledgement of debt.

5. ......... cannot

carry any voting rights.

Ans. 1. 1 year; 2. Ownership Securities; 3. Equity shares;

4. A debenture; 5. Debenture holders

3. Convertible

preference shares can be converted into

shares after a specified period of term.

4. is a document of acknowledgement of debt.

5.

cannot carry any voting rights. MIS.

Ans.1. 1 year; 2. ownership

Securities; 3.

equity shares; 4. A

debenture;

5. Debenture holders

C. True or False

1. Without adequate

finance, no business can carry out its operations.

2. Preference

shareholders are not the owners of the company.

3. Equity shares

cannot be redeemed except in case of winding up of company.

4. In cash credit a customer is given credit

upto a definite limit against his current assets.

5. ADR represents the number of shares hold by

an foreign investor in a company registered in India.

Ans. 1. True, 2. True, 3. True,

4. True, 5. True

D. MCQ

1. What is life blood of every business

enterprise?

(a) Cash (c)

Government

(b) Finance

(d) Owner

2. Medium term

finance is generally required for a period of:

(a) 1 to 3 years (b) 2 to 5 years

(c) 2 to 4 years (d)

1 to 5 years

3. Short term finance

is also called as

(a) Short Term

Capital (c)

Retained Earnings

(b) Working Capital

(d) Both (a) and (b)

4. Debentures are a part of:

(a) Owned Capital (b)

Borrowed Capital

(c) Both a and b (d) None of the above

Ans. 1. (b), 2. (b), 3. (d), 4. (b)

-18- Entrepreneurship

Development

A. One Word or One Line

Questions

Q. 1. Which are

four key factors of production?

Ans. Four key factors

of production are land, labour, capital and entrepreneur.

Q. 2. Who is an

entrepreneur?

Ans. An entrepreneur

is a person who takes the initiative to set-up a business unit.

Q. 3. Define

Entrepreneurship Development.

Ans. Entrepreneurship

Development refers to the process of development of entrepreneurial qualities

of the entrepreneurs.

Q. 4. Write any one feature of entrepreneurship

development.

Ans. It is a system

process of development entrepreneurial qualities.

Q. 5. Describe any one point highlighting the need for

entrepreneurship development.

Ans. Entrepreneurship

development is needed to promote rapid economic growth in the country.

Q. 6. What is

Start-up India scheme?

Ans. It is a flagship

initiative of the Government of India to promote innovations and

entrepreneurship in the country.

Q. 7. Which are the three key areas of Start-up India

scheme?

Ans. (i) Simplification and hand holding. (ii) Funding

support and incentives. (iii) Industry academia partnership and incubation.

Q. 8. What should be the annual turnover of a business

unit to be considered as under start-up India scheme?

Ans. Annual turnover

should not exceed Rs. 100 crore in any of the preceding years.

Q. 9. Write any one feature of Start-up India Scheme.

Ans. It is a scheme

which aims to encourage entrepreneurship.

Q. 10. What is crowd funding?

Ans. Under crowd

funding, funds to finance a start-up are collected from a large number of

people.

B. Fill in the blanks

1. The process of entrepreneurship is undertaken

by..............

2. ..............scheme aims to promote innovations

and entrepreneurship in India.

3. To be included under Start-up India Scheme, a

business entity must not be more than..............years old.

4. Start-up India scheme was launched in..............

5. If bank finance is not available, then start-ups

can be financed through.............. finance.

6. Intellectual property rights for literary and

artistic works are granted under ..............

7. Products having geographical origin are protected

under..............

Ans. 1. entrepreneurs, 2. Start-up India, 3. ten,

4. August 2015, 5. micro,

6. copyright, 7.

geographical indication

C. True or False

1.

Entrepreneurship development helps to achieve a rapid rate of economic growth.

2. Environmental factor do not play any role in

entrepreneurship development.

3. Starting

India scheme is fuanded by the World Bank.

4. Industry-academia partnership is also one of the

key areas of Start-up India Scheme.

5. Start-up India scheme aims to promote innovations

and entrepreneurship development.

6. For getting

benefits under Start-up India scheme, a business unit need not be incorporated

or registered in India.

7. Venture Capital is also a method to fund start-ups.

8. The property created with the help of human

intellect is known as Intellectual Property.

Ans. 1. True 2. False 3. False

4. True _ 5. True 6. False

7. True 8. True

D. MCQ

1. Why is entrepreneurship development needed?

(a) To develop efficient entrepreneurs (b) To encourage

innovations (c) Both (a) and (b) (d)

None of these

2. When was Start-up India scheme launched in India?

(a) January 26, 2015 (b)

August 15, 2015

(c) October 02, 2015 (d)

None of these

3. Which one of

the following is not one of the three key areas of Start-up India Scheme

(a) Starting-up of a new business unit.

(b) Industry-academic partnership.

(c) Funding support and incentives.

(d)

Simplification and handholding.

4. Which one of

the following is not true about Start-up India scheme?

(a) It aims to promote entrepreneurship in the

country.

(b) Tax

benefits are not given to business units under it.

(c) Both (a) and (b)

(d) None of

these

5. Which one of the following is a way to fund a

Start-up in India?

(a) Boot Strapping

(b) Crowd

Funding

(c) Both (a) and (b)

(d) None of these

6. Which of the following statement is correct?

(a) Incubators provide funds to start-up in their

initial stages.

(b) Accelerators provide funds to start-up in their

initial stages.

(c) Both (a)

and (b)

(d) None of these.

7. Those start-ups which fail to get finance from

banks, from where can those obtain funds?

(a) Micro finance and

NBFCs

(b) Venture Capital

(c) Winning Contest Funds

(d) None of these

8. Which one of the

following is not a type of intellectual property?

(a) Industrial Design

(b) Venture Capital

(c) Trademark

(d) Copyright

9. Which one of the following is not

industrial property?

(a) Copyright

(b) Trademark

(c) Industrial Design

(d) All of these

10. Who among the

following don't have copyrights?

(a) Authors

(b) Agriculturalists

(c) Artists

(d) Architects

Ans. 1. (c) 2. (b) 3. (a) 4. (b)

5. (c) 6. (a) 7. (a) 8. (b)

9. (a) 10.

(b)

-19- Small Scale Enterprises

A. One Word or One Line

Questions

Q. 1. Which are

various categories of small scale enterprises in India?

Ans.Various categories of small scale

enterprises in India are micro, small and medium enterprise.

Q. 2. Under

which act, were small scale enterprises defined in India?

Ans. Small scale enterprises were defined in India under

Micro, Small and Medium Enterprises Development act 2006.

Q. 3. When were the recent changes made in the

definition of MSMEs?

Ans. May and June 2020.

Q. 4. How are MSMEs being defined in India under the

latest revision of their definition?

Ans. As per the

revision carried out in May and June 2020, MSMEs are being defined on the basis

of investment made and annual turnover.

Q. 5. How are

micro enterprises defined as present?

Ans. Micro

Enterprises: (1) Investment: Less than Rs.1 crore

(2) Annual

Turnover: Less than Rs.5 crore.

Q. 6. Define

small enterprises as per the latest definition.

Ans. Small